Gold is a fairly effective tool in the fight against inflation. Here are the main arguments in favor of purchasing it:

- The amount of gold on Earth is limited, which theoretically makes it resistant to devaluation during periods when money is printed in large quantities (which often leads to inflation).

- This precious metal has historically preserved its value in the long term. It can serve as a “safe haven” during times of economic instability and currency depreciation.

- Gold is a good alternative to fiat money. It is not subject to the policies of central banks and governments, which can influence the value of national currencies.

Preserving capital is not an easy task, and investing in gold can help. Precious metals are widely used as a hedging tool to manage risk and minimize losses caused by fluctuations in prices, exchange rates, and interest rates.

Investments in gold bars and coins almost always generate profits. Financial security is important for all — business owners, wealthy individuals, and anyone seeking to preserve and grow their assets.

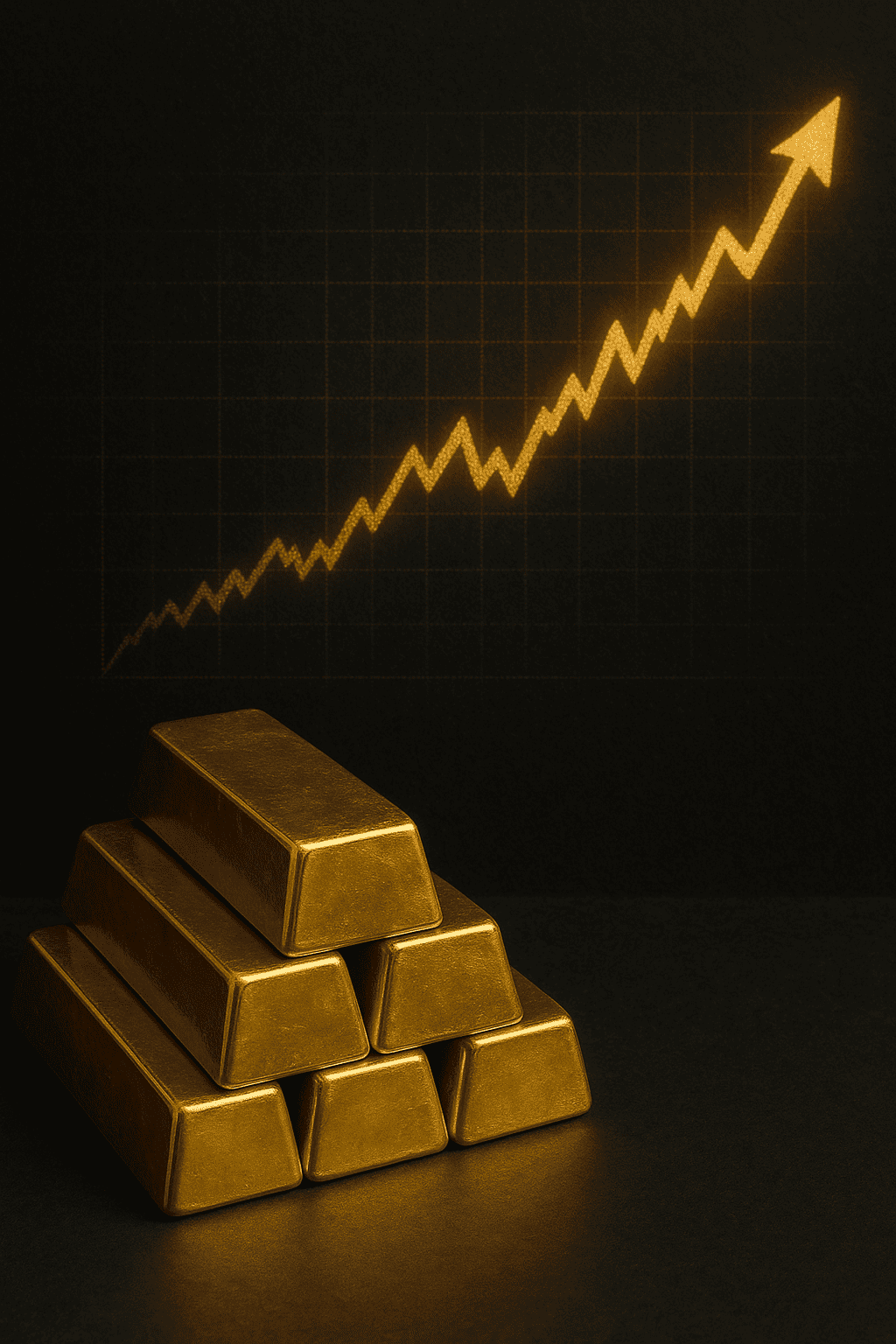

Economic recession forces people to look for new and highly reliable investment strategies. Gold can be part of an inflation protection strategy, but the best approach is to diversify your investments. Including precious metals in your portfolio can reduce overall volatility, as they often have a low correlation with other assets such as stocks and bonds. Investing in gold is definitely worthwhile — its value often rises when the purchasing power of currency declines.

Always analyze the inflation rate before making any investments, and monitor the gold price so you don’t miss the chance to buy this precious metal at the best possible rate. Gold’s purchasing power remains high even in times of economic uncertainty — and that’s its biggest advantage.