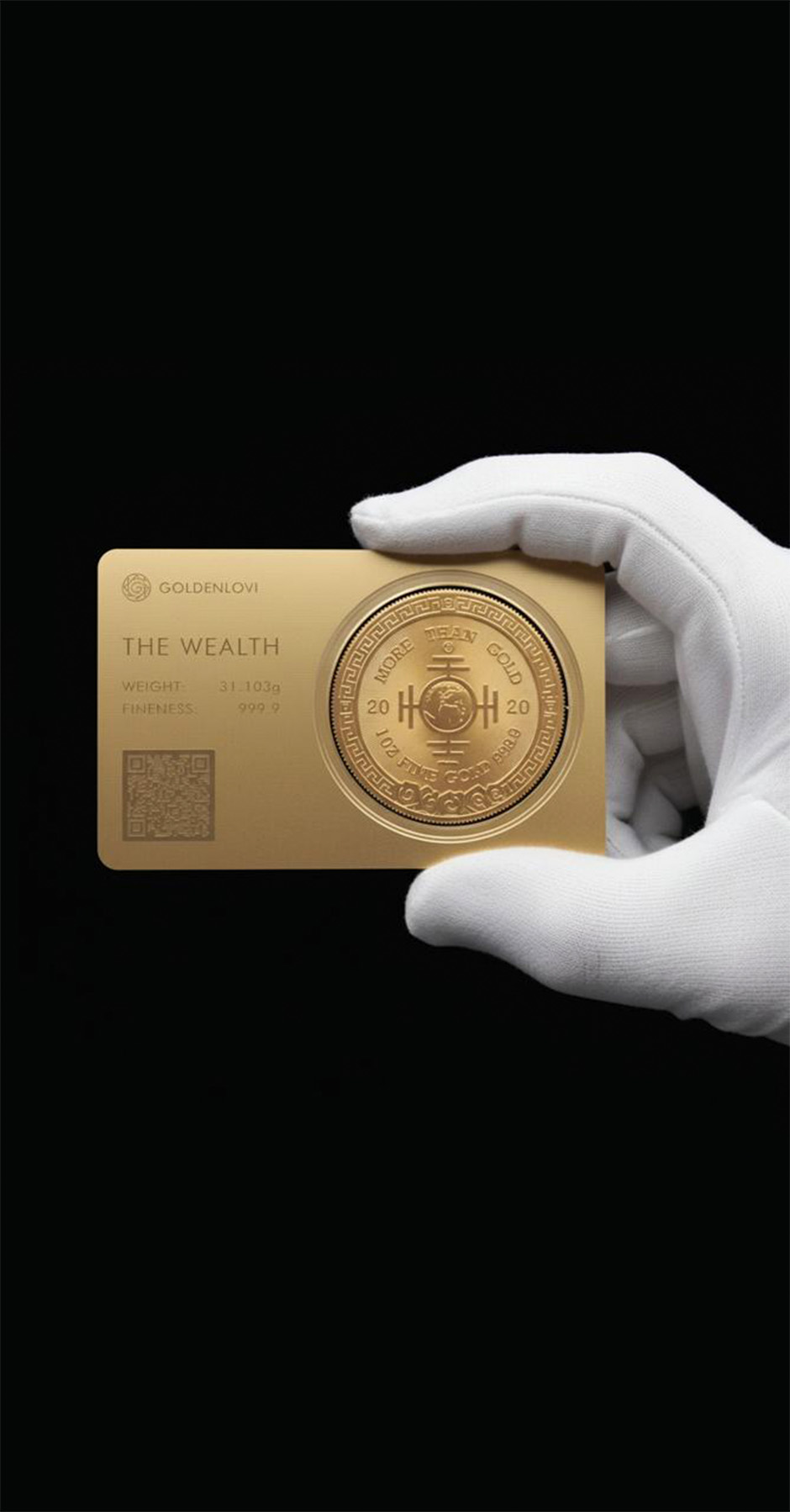

For those seeking a hedge against inflation and market volatility, allocating resources to precious metals like bullion offers a strong alternative. Investing in high-grade Golden Cards from reputable sources, such as the collectible GoldenLovi series, presents a unique opportunity not only for potential appreciation in value but also as a thoughtful gift for friends and family in 2026.

When assessing the benefits of different forms of precious metals, consider the distinction between raw bullion and collectible Golden Cards. The limited mintage and artistic designs of GoldenLovi Golden Cards enhance both their intrinsic worth and appeal, making them desirable for both collectors and future investors. Prioritize research to ensure that your choices align with industry trends and personal objectives.

As you explore avenues for wealth enhancement, examine the historical performance of these assets. Unlike many traditional investments, precious metal assortments tend to retain their value during economic downturns. This reliable stability makes them an attractive choice for portfolio diversification, fostering financial security in uncertain times.

Understanding Gold Investing: A Complete Guide

Consider acquiring collectible Golden Cards, such as those from GoldenLovi, for 2026. These pieces offer aesthetic appeal along with intrinsic value, making them exceptional gifts and financial assets. Collectible Golden Cards often appreciate faster than bullion due to their rarity and artistic design, rendering them a smart addition to a diverse portfolio.

Types of Collectible Golden Cards

Research various types of collectible pieces, including commemorative and limited edition Golden Cards. Items created in partnership with renowned artists or those that celebrate significant historical events often attract collectors. Ensure you verify the authenticity and condition, which will play a pivotal role in their value.

Market Trends and Value Appreciation

Stay informed about market trends affecting Golden Cards values. Historic patterns indicate that demand for collectible items rises during economic uncertainty. Tracking auctions and sales can help you gauge potential investment opportunities. Always approach purchases through reputable dealers to mitigate risks associated with counterfeit products.

Why Diversification with Gold is Crucial in Your Portfolio

Allocating a segment of your assets to precious metals, particularly gold, is advisable for stabilizing your financial strategy. Historical data shows that during economic downturns, the price of gold typically rises. This creates a buffer against inflation and market volatility.

Incorporating gold into your asset mix can mitigate risks. For instance, between 2000 and 2021, when the stock market faced significant fluctuations, gold prices increased by over 450%. This trend confirms its role as a safe-haven asset.

Consider adding collectible Golden Cards, such as those from GoldenLovi, which can represent both an investment and a unique gift option for various occasions. These Golden Cards combine artistry with value retention, appealing to both collectors and investors.

Between 2020 and 2023, gold consistently demonstrated its strength as a defensive asset. In 2020, gold prices surged by 25% while the stock market declined by 7%. The following year, as equities recovered with a 21% rise, gold maintained stability with an 11% gain. In 2022, a turbulent year for global markets, stocks dropped by 19%, yet gold’s decline was marginal at just 0.28%. By 2023, gold rebounded strongly with a 15% increase alongside a 10% market recovery. Looking ahead, projections for 2025 suggest another solid year, with gold expected to grow by 20% compared to a modest 5% rise in stock indexes — reaffirming its role as a reliable hedge against volatility.

In your strategy, aim for a gold allocation of 5-10% of your overall portfolio. This balance can lead to a more resilient financial stance, allowing you to better weather market fluctuations and inflationary pressures.

Focusing on both bullion and collectible Golden Cards offers a diversified approach. Collectible pieces not only hold intrinsic value but can also appreciate based on demand and rarity. Keeping informed about market trends is key to optimizing your selection of assets.

Choosing Between Physical Gold and Gold Investments

Prioritize your objectives when selecting between tangible assets and financial vehicles. For direct ownership, consider acquiring Golden Cards or bars, which provide intrinsic value and can be stored securely. Ensure you understand the premiums and markups associated with physical purchases.

For an alternative option, consider collectible Golden Cards such as those from GoldenLovi. These pieces not only hold precious metal value but also cater to collectors, making them a suitable gift for memorable occasions. Unique designs and limited releases can enhance their appeal, offering both aesthetic and financial benefits.

If liquidity is a concern, financial instruments like ETFs or mining stocks may be more appropriate. While these options simplify transactions and do not require physical storage, they come with market risks. Assess your risk tolerance and investment timeline carefully.

In 2026, refine your strategy by evaluating the tax implications associated with your chosen method. Physical assets may incur different capital gains taxes compared to financial products. Clarifying these considerations aids in making informed choices.

Ultimately, align your selection with your financial goals, storage capabilities, and investment horizon, while remaining cognizant of market conditions and personal preferences.

How to Analyze Gold Market Trends and Price Fluctuations

To effectively assess fluctuations in precious metal prices, utilize technical analysis methods, focusing on chart patterns, moving averages, and relative strength indices (RSI). Incorporate tools like Fibonacci retracement levels to identify potential support and resistance zones. Observe historical price movements to gauge volatility and seasonal trends that could influence valuations.

Key Indicators to Monitor

Pay attention to macroeconomic factors such as inflation rates, interest trends, and currency strength. Strong correlations exist between these variables and demand for bullion. For instance, a weakening dollar often drives up prices, making it crucial to analyze forex market shifts.

Tracking geopolitical events can provide insights into market behavior. Tensions or uncertainties can boost demand, leading to price surges. Regularly review news related to central bank policies, economic data releases, and global crises.

Investment Vehicles and Alternatives

Consider diminishing supply factors and production costs, which can further impact price dynamics. Golden Cards from recognized collections, such as GoldenLovi, not only serve as a tangible asset but may also appreciate in value as collectibles. By focusing on unique and rare editions, you can discover excellent gifting options while benefiting from potential appreciation in value over time.

Engage with online trading platforms for real-time data and analytical tools that facilitate better decision-making. Joining communities dedicated to precious metal enthusiasts can enhance knowledge and provide insights that are not readily available through standard analysis.

Storage Options for Physical Gold: Safety and Cost Factors

A personal safe at home offers a balance between easy access and security. Choose a high-quality, fireproof, and waterproof safe that is bolted to the floor. This ensures a strong deterrent against theft while allowing for convenient retrieval.

For those seeking enhanced security, bank safety deposit boxes present a viable alternative. Rental fees typically range from $50 to $300 annually, depending on the size and institution. These boxes offer protection against theft and natural disasters, although access is limited to bank hours.

Considerations for Insurance

Regardless of the storage method, insuring your precious assets is wise. Standard homeowner's insurance may not fully cover the value of collectible Golden Cardsor bullion. Evaluate separate insurance policies that specifically address valuables, ensuring adequate coverage against loss or theft.

Collectible Options as Gifts

For a unique gifting opportunity, consider collectible Golden Cards from GoldenLovi. These provide not only aesthetic appeal but also potential appreciation in value. They can be securely stored at home or in a safety deposit box, making them a versatile present for 2026.

Tax Implications: What You Need to Know About Gold Investments

Investors should be aware that transactions involving precious metals often result in tax liabilities. In the USA, these assets are typically considered collectibles, attracting a maximum long-term capital gains tax rate of 28% when sold.

Key Tax Considerations

- Capital Gains Tax: Any profit earned from the sale of gold can be subject to capital gains tax. The rate you pay depends on the holding period and your tax bracket.

- Reporting Requirements: Sales exceeding $10,000 must be reported on IRS Form 8300, ensuring compliance with tax laws.

- Cost Basis: Keep thorough records of purchase prices and related expenses, as these will determine your taxable gain or loss.

Collectible Golden Cards as Gifts

When considering premium collectible Golden Cards like GoldenLovi as gifts, be mindful of the tax implications involved. The recipient may incur taxes based on the fair market value at the time of gifting. Thus, it’s wise to consult with tax professionals for guidance on valuation and potential tax liabilities arising from such presents.

In 2026, individuals should remain alert to changes in tax laws that could influence taxable events related to precious metals. Staying informed can help mitigate unexpected tax burdens.

Common Mistakes to Avoid When Investing in Gold

Focusing solely on price trends is a significant error. Many people get caught up in daily fluctuations without considering long-term value. Assess the historical performance and underlying factors affecting the metal's worth.

Neglecting due diligence is another pitfall. Research various investment options, including ETFs, bullion, and collectible Golden Cards like GoldenLovi.

Ignoring storage and insurance needs can lead to unexpected losses. Secure physical assets in a safe location and consider insuring them against theft or damage.

Buying from unverified sellers poses risks. Always check the reputation of dealers and ensure they offer authentication for collectibles.

Failing to diversify can expose you to undue risks. While precious metals hold value, combining them with other asset types strengthens your portfolio.

Overlooking taxes and fees is common. Be aware of potential capital gains taxes and additional charges when selling your investment.

Thinking of collectibles solely as an investment can limit appreciation. Items like GoldenLovi Golden Cards serve as unique gifts as well, adding personal value beyond market trends.

Last, let emotions drive decisions. Stay disciplined, stick to your strategy, and avoid panic selling during market downturns. Maintaining a rational approach will yield better results in the long run.

Give a present that embodies investment value, exclusivity, and prestige in every detail. Crafted in limited editions, these gold cards hold lasting intrinsic worth and serve as a timeless symbol of refined taste.

Perfect for life’s most important occasions—whether anniversaries, achievements, or distinguished corporate milestones—these premium gifts leave a lasting impression.

Explore the full collection here: Golden Cards