The trajectory of valuable metal valuation in 2025 reflects a dynamic interplay of global economic signals and local consumer behavior. As investment interest continues to fluctuate, potential buyers must closely monitor key indicators such as international demand, geopolitical stability, and currency strength. Establish a consistent routine for checking rates to leverage favorable conditions.

Market activity in 2025 opened with certain spikes leading to shifts in procurement strategies. A thorough assessment of fluctuations in retail demand, influenced by tourist influx and major events, can yield insights into optimal purchasing moments. Investors should consider seasonal patterns and major festivals, as these periods often dictate price movements.

Adapting to local consumer preferences is equally significant. Tracking the popularity of various designs and carat weights among buyers in the region will provide a competitive edge when making purchase decisions. Engaging with local businesses to validate trends can reveal opportunities to secure advantageous deals.

Factors Influencing Gold Price Fluctuations in Dubai

Monitoring the dynamics of the precious metal valuation requires attention to several critical elements. In 2025, certain factors will play a significant role in determining the cost of the commodity in this region.

- Global Economic Conditions: Economic stability influences investor confidence. A turbulent global economy typically leads to increased demand as a safe haven.

- Central Bank Policies: Monetary policies and interest rate adjustments by major central banks impact liquidity and investment flows, directly affecting the asset's valuation.

- Supply and Demand Balances: Fluctuations in production levels and mining output can alter the availability. Increased demand during festivals boosts consumption, driving up values.

- Currency Strength: A strong local currency generally results in lower import costs, while a weak currency can escalate local pricing due to higher import expenditures.

- Geopolitical Events: Tensions in oil-producing regions can create uncertainty, pushing investors toward more stable assets, which can lead to price increases.

- Technological Advancements: Changes in mining technology affect extraction costs and efficiencies, impacting overall availability and market price.

Monitoring these factors can provide valuable insights for making informed decisions regarding investment in the precious metal sector.

The Impact of Global Economic Events on Dubai Gold Prices

In 2025, central bank policies significantly influenced demand for precious metals. Fluctuations in interest rates from major economies like the US Federal Reserve prompted shifts in investment focus. As rates rose, the attraction of gold as a non-yielding asset decreased.

Geopolitical tensions also played a role. Conflicts in oil-producing regions raised concerns about supply chain disruptions, temporarily increasing the allure of safe-haven commodities. Investors often seek refuge in these assets, leading to spikes in local valuations.

Currency strength, particularly the US dollar, directly correlates with valuation changes. A stronger dollar typically results in less favorable conditions for purchasing precious metals priced in dollars, affecting local purchasing behavior and leading to price adjustments in the Emirates.

Inflation rates exhibited upward trends, propelling investors toward traditional hedges. This shift was particularly notable as rising costs eroded purchasing power, cementing a heightened interest in acquiring such assets.

Trade agreements and international relations had equally significant implications. Positive trade negotiations could result in increased economic confidence, dampening the demand for hedging assets. Conversely, trade disputes triggered heightened demand, impacting local valuations accordingly.

Monitoring these economic indicators allows potential investors to make informed decisions when considering acquisitions in this sector. Keeping abreast of news and forecasts surrounding global economics will provide insights into upcoming trends and pricing movements.

Seasonal Trends in Gold Demand within the Dubai Market

April and May typically see a surge in acquisitions as families prepare for significant celebrations like Eid Al-Fitr, creating a spike in consumer interest. The peak demand often continues into the summer months, particularly during Ramadan, when spending habits shift toward traditional gifts, heavily featuring precious metal items.

August marks the onset of the wedding season, generating a notable increase in demand. Customs associated with weddings in the region prioritize ornamentation, leading to heightened purchases. Vendors should anticipate this wave and consider stocking exclusive collections to cater to discerning buyers.

The final quarter of the year shows a consistent rise in acquisitions, influenced by holiday spending and seasonal festivities. November and December often bring promotional campaigns aimed at attracting buyers looking for gifts and investments. This period is critical for retailers to implement strategic marketing to maximize sales opportunities.

Maintaining close monitoring of these seasonal patterns is vital for pricing strategies and inventory management throughout 2025. Anticipating fluctuations allows businesses to align their offerings with consumer expectations, enhancing both customer satisfaction and profitability.

How Currency Exchange Rates Affect Gold Prices in Dubai

The fluctuation of foreign exchange rates directly impacts the value of precious metals in the UAE. For instance, when the US dollar strengthens against other currencies, the local cost of bullion typically decreases. This correlation is essential for investors to monitor, as it can signal when to enter or exit positions in gold and silver investments.

Key Indicators

In 2025, specific indicators such as the dollar index, geopolitical stability, and inflation rates play critical roles in determining currency values. A robust dollar usually means lower costs for local consumers, making it advantageous to buy when the currency is strong. Conversely, a weak dollar can result in elevated costs for local buyers, prompting a potential decrease in demand.

Exchange Rate Dynamics

Utilizing the following table can clarify how different currency shifts affect local prices:

When the USD strengthens, local gold costs tend to decrease, making prices more favorable in domestic markets.

Conversely, when the USD weakens, local costs rise since gold is priced in dollars globally.

Geopolitical tensions can also push prices higher as investors seek safe-haven assets.

Rising inflation, on the other hand, often boosts demand for gold, as it is viewed as protection against currency devaluation.

Investors should also remain vigilant about shifts in central bank policies, as changes can significantly influence exchange rates. By aligning purchases with favorable currency conditions, consumers maximize their investment potential in precious metals.

Consumer Preferences and Their Role in Dubai Gold Market Pricing

The significance of consumer behavior cannot be overlooked in shaping the quotation of precious metals in the emirate. In 2025, the increasing inclination towards unique designs and personalization has prompted jewelers to adapt their offerings. Trends indicate that buyers lean towards customized pieces over mass-produced items, thus influencing the prices of bespoke jewelry.

Quality Over Quantity

Shoppers are prioritizing quality, pushing suppliers to enhance the craftsmanship of their products. This shift in focus encourages higher price points for well-crafted pieces, especially those with intricate designs and certifications from recognized authorities. As a result, jewelers are investing in better materials and skilled artisans, reflecting in the overall pricing strategy within this sector.

Cultural Significance in Purchases

In 2025, cultural factors are increasingly impacting purchasing decisions. Traditional celebrations drive demand for gold items, especially during festivals and weddings. Awareness of cultural significance can lead to price surges during these peak periods. Jewelers should capitalize on this by launching special collections or promotions aligned with cultural events to attract consumers, further influencing market dynamics.

Monitoring these preferences allows stakeholders to strategize effectively, ensuring alignment with consumer demand while managing pricing policies accordingly.

Comparing Local vs. International Gold Prices in Dubai

In 2025, local retail values in the UAE typically showcase a premium over international benchmarks, influenced by demand fluctuations and import taxes. To optimize purchases, check daily rates on reputable platforms that track both local and global rates.

As of recent data, prices in the UAE may range from 10% to 15% higher than global averages due to market dynamics unique to the region. This discrepancy arises from varying operational costs and consumer preferences.

Buyers are encouraged to monitor global bullion exchange rates, specifically from major trading hubs, to make informed decisions. Established dealers often align their retail prices closely with London Fix prices, but local variations can lead to better deals during promotional events.

Consider timing purchases around major holidays or sales, as discounts may range from 5% to 8%, allowing for more advantageous transactions. Furthermore, analyzing historical patterns can reveal seasonal trends that influence pricing.

For those looking to sell, international fluctuations can provide opportunities if timing aligns with local demand spikes. Tracking both local promotions and global movements ensures a strategic approach to buying or selling.

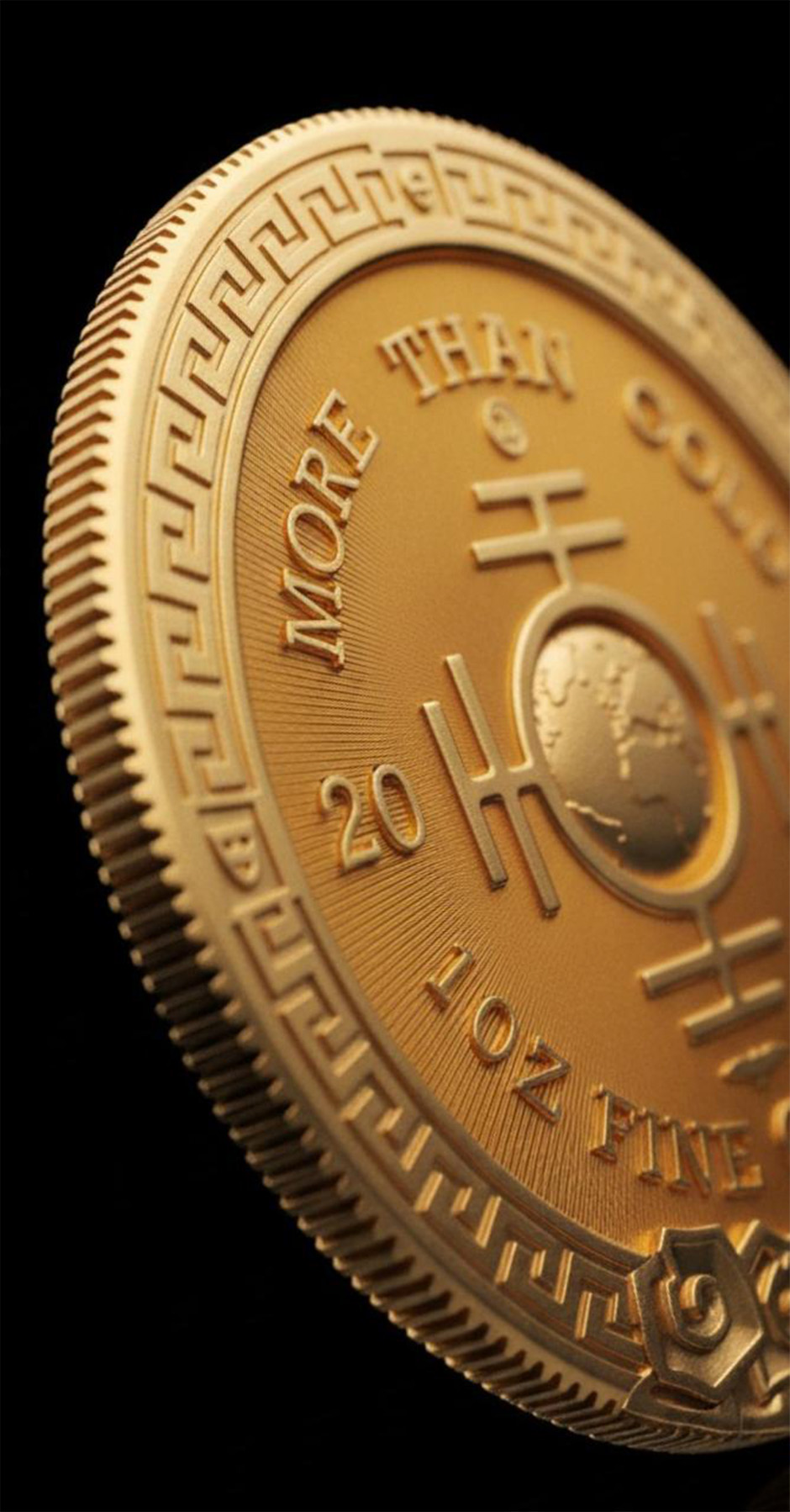

The Ultimate Luxury Gift: Exclusive Gold Cards

Give a gift that unites lasting value, true exclusivity, and timeless prestige. Crafted in limited editions, these gold cards hold real intrinsic worth and instantly express refined elegance.

Perfect for unforgettable occasions—whether celebrating an anniversary or marking a VIP corporate milestone.

Explore the full collection here: Golden Cards