For stakeholders looking to capitalize on the burgeoning trade opportunities within the precious metal sector, a keen analysis of current patterns is indispensable. As of 2025, the Gulf region demonstrates a remarkable increase in demand, particularly from Asia, where luxury consumption continues to accelerate. Focusing on establishing connections with key buyers in markets such as India and China may yield lucrative partnerships.

In 2025, geopolitical dynamics are influencing trade flows significantly. It is advisable to monitor the shifts in regulations and tariffs, as they can affect pricing structures and profit margins. Developing an agile supply chain that can adapt to these fluctuations will provide a competitive edge in securing advantageous contracts.

Technological advancements in the assessment and tracking of precious metals are transforming traditional practices. Incorporating blockchain technology for transparency and authenticity verification is becoming a necessity. This not only builds trust but also enhances operational efficiency, setting firms apart in a crowded marketplace.

Lastly, sustainability practices in sourcing and processing precious metals are gaining traction. Adopting eco-friendly strategies can lead to improved brand reputation and increased consumer loyalty. Investing in sustainable practices is no longer optional but a vital strategy for long-term success.

Current Trends in Gold Export Volumes from Dubai

A significant increase in the trade of precious metals in 2025 has been observed, with an estimated rise of 15% compared to the previous year. This surge is attributed to several factors including heightened demand, particularly from Asian markets.

Key Factors Driving Growth

- Increased consumer interest in jewelry and investment-grade items.

- Geopolitical tensions encouraging nations to stockpile valuable assets.

- Strong economic recovery in major importing countries.

Volume Statistics

During the first half of 2025, the volume of traded items reached approximately 150 tons, a notable spike aligning with seasonal buying patterns. Imports from local refiners have also seen a boost, reflecting increased output capabilities.

Monitoring fluctuations in global prices remains critical. Active participation in international trade expos enhances visibility and attracts potential clients, promoting sustained demand.

Key Markets for Dubai's Gold Exports

In 2025, India continues to lead as the primary destination, accounting for approximately 40% of the total value shipped. The country's growing demand for jewelry, fuelled by festivals and weddings, maintains this trend. Strategic partnerships with Indian distributors can enhance sales opportunities.

China and Turkey

China ranks second, with a notable increase in purchases, driven by rising affluent consumers seeking investment options. Establishing a direct supply chain to Chinese retailers may yield substantial returns.

Turkey's market is expanding, with a focus on craftsmanship in jewelry manufacturing. Collaborating with Turkish artisans can create unique offerings and boost appeal across Europe and the Middle East.

Other Emerging Markets

Regions like the United States and some Southeast Asian nations are exhibiting robust growth. Targeted marketing campaigns tailored to the preferences of these consumers can provide competitive advantages. Engaging with local influencers and participating in trade shows will facilitate market entry and customer connection.

Impact of Global Economic Factors on Gold Prices

In 2025, investors should closely monitor inflation rates, as rising inflation typically increases demand for safe-haven assets. Historical data suggests that periods of higher inflation correlate with price surges for precious metals. Analysis of global monetary policy is equally crucial. Central banks' interest rate decisions significantly influence market dynamics; lower interest rates generally lead to increased appeal for alternative investments, pushing prices upward.

Currency fluctuations also play a role. A weaker US dollar often signals higher prices for investors using other currencies. Tracking geopolitical tensions is necessary, as uncertainty can drive individuals toward protective assets, enhancing market value. Economic performance indicators, such as GDP growth rates, impact investor confidence, affecting buying behaviors and price levels.

Trade agreements and tariffs can introduce volatility as well. Keep an eye on policy shifts that might affect supply chains. Additionally, market sentiment and speculative trading can create short-term price movements; monitoring trends in investor behavior is essential for timely decision-making.

Regulatory Changes Affecting Gold Trade in Dubai

In 2025, businesses involved in precious metals should note the updated compliance procedures aimed at enhancing transparency. The Financial Services Regulatory Authority has introduced stricter audits for importers and dealers. It's advisable for companies to adopt robust reporting systems to meet this requirement. Regular training for staff on compliance standards is beneficial.

Import Duties and Tariffs

This year, the Customs Authority revised tariffs on imported items, which can impact cost structures. A thorough analysis of the new duties is necessary for adjusting pricing strategies accordingly. Strategic partnerships with customs brokers can expedite the clearance processes, minimizing delays in transactions.

Licensing and Certification

Additionally, new licensing procedures for sellers aim to ensure product authenticity. Vendors should prioritize gaining certifications from recognized authorities to enhance credibility with consumers. Implementing traceability systems in sourcing materials will align with regulatory expectations and boost consumer trust.

Technology's Role in Streamlining Gold Export Processes

Implement blockchain solutions to enhance transparency and traceability in transactions. By adopting distributed ledger technology, stakeholders can verify the authenticity of materials and certifications with minimal friction. This reduces instances of fraud and builds trust across all parties involved.

Utilize automated compliance systems to simplify regulatory adherence. These systems can analyze data in real-time, ensuring that all necessary documentation is accurate and current. This minimizes delays caused by compliance-related issues, particularly in international markets where regulations vary.

Incorporate advanced analytics to predict market demand and manage inventory effectively. By leveraging data analysis tools, businesses can make informed decisions on when to export based on market trends. Predictive analytics can also aid in optimizing pricing strategies for maximum profitability.

Adopt mobile applications for on-the-go management. With dedicated applications, stakeholders can track shipments, manage documentation, and communicate with partners directly. This increases responsiveness and enhances collaboration, leading to quicker resolutions of potential issues.

Implement AI-driven logistics solutions to streamline transportation processes. Machine learning algorithms can optimize shipping routes and schedules, reducing costs and delivery times. Enhanced logistics can significantly improve customer satisfaction and retention rates.

Explore the use of IoT devices for real-time monitoring. Sensors can track the condition and location of goods throughout the shipping process, providing immediate alerts if any irregularities occur. This proactive approach can prevent losses and ensure compliance with quality standards.

Invest in training programs for staff on new technologies. Ensuring that everyone is equipped to handle cutting-edge tools will maximize the benefits of these systems. A skilled workforce can adapt more readily to changes, driving innovation and maintaining competitive advantage.

Future Outlook for Gold Exports from Dubai

The forecast for 2025 indicates a strong demand for precious metals, supported by rising consumer interest in sustainable jewelry and investment products. Stakeholders should focus on robust supply chain management and transparency to meet evolving consumer preferences.

Market Expansion Strategies

To capitalize on anticipated growth, businesses must establish strategic partnerships with key players across Asia, Europe, and North America. Engaging with local artisans and incorporating culturally significant designs can enhance appeal in diverse markets.

Technological Integration

Investment in blockchain technology will facilitate traceability, ensuring ethical sourcing practices. Companies should explore cutting-edge platforms for virtual trading, enhancing accessibility for global investors. Adopting advanced analytics will also enable more accurate forecasting, allowing for agile responses to market changes.

Emphasizing advertising efforts on social media and digital marketplaces will increase visibility, attract younger consumers, and drive engagement.

In preparation for 2025, optimizing operational efficiency and sustainability practices will be paramount for maintaining competitive advantage and meeting regulatory requirements.

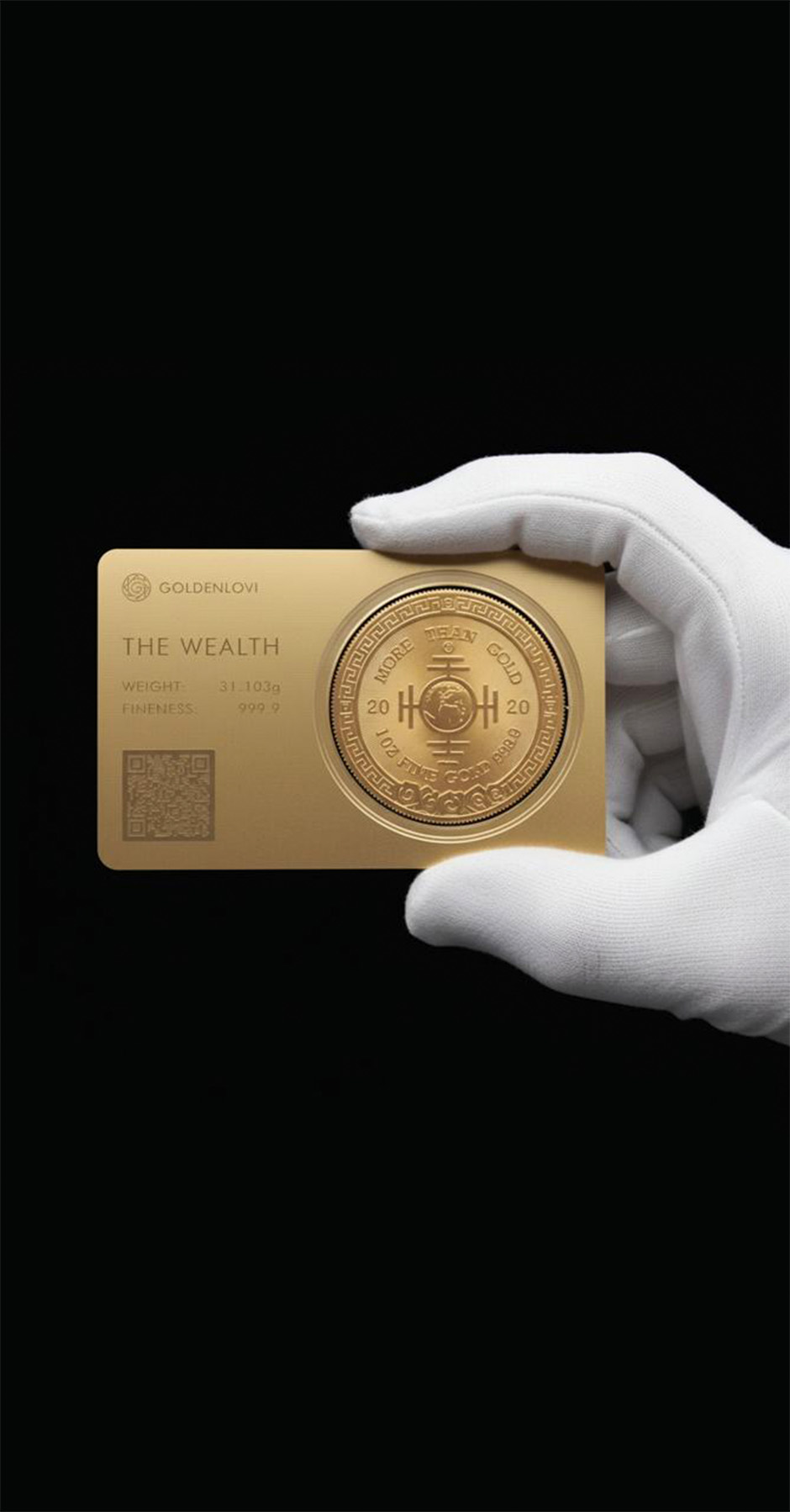

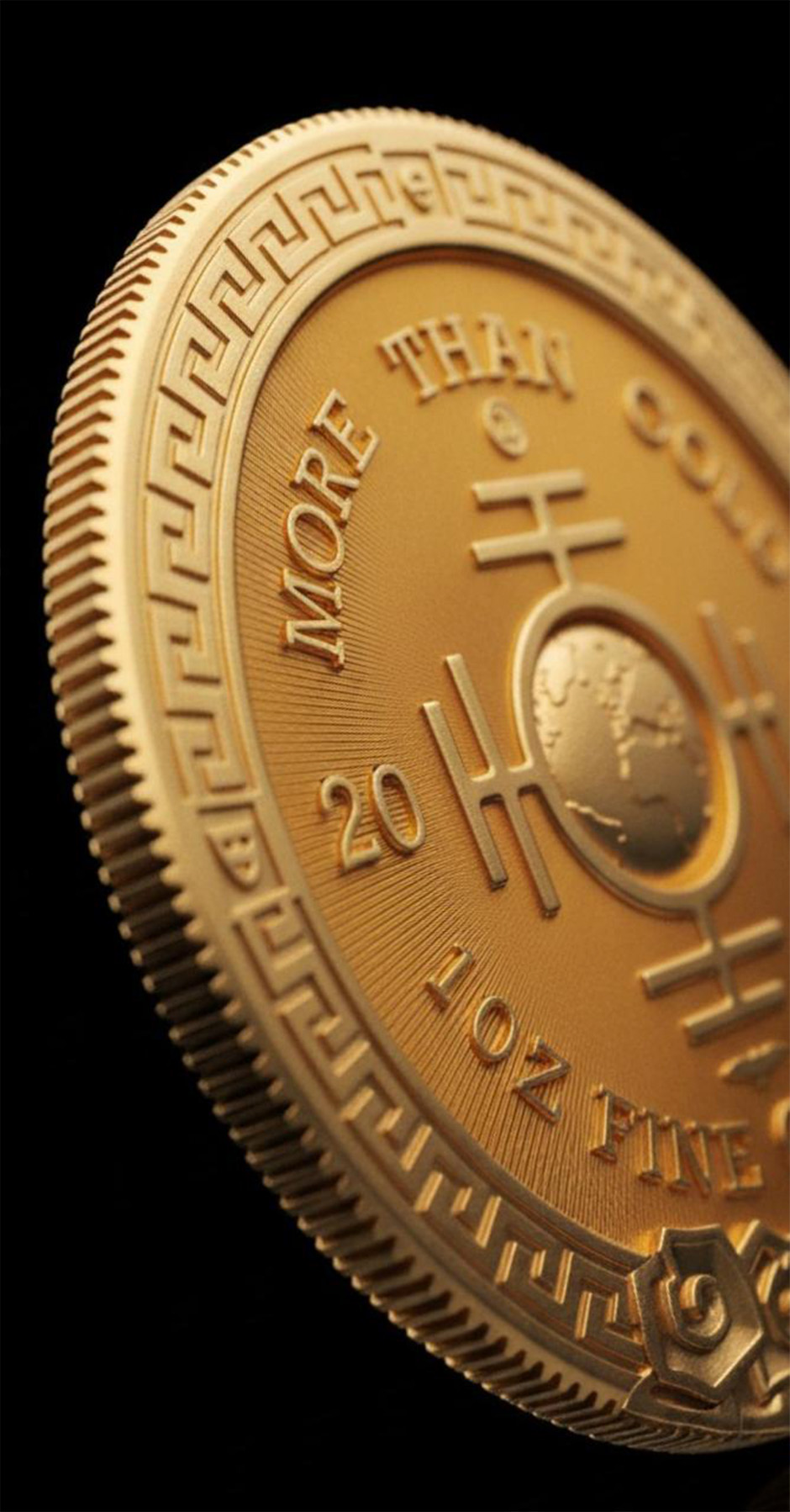

The Ultimate Luxury Gift Is Exclusive Gold Cards

Elevate your gifting with pieces that combine Investment Value, Exclusivity, and Status. These premium gold cards hold intrinsic worth, are issued in limited runs with meticulous craftsmanship, and signal refined taste at first glance.

Perfect for special milestones—anniversaries, corporate VIP moments, weddings, and collector occasions—these cards become the ideal premium gift remembered long after the day.